39+ what is a reverse mortgage for seniors

It allows homeowners to access the equity theyve built up over the years like a second or third income. These loans are expensive and in several different types of circumstances the lender can call the loan due.

Hecm Reverse Mortgage Capital Mortgage Advisors

Certain criteria must be met to qualify for a reverse mortgage including owning your own home and having enough equity.

. Check out some of our other guides to senior housing to help you compare what your options are as you age. Web A reverse mortgage is a type of loan reserved for seniors ages 62 and older which does not require monthly mortgage payments. No income is required to qualify.

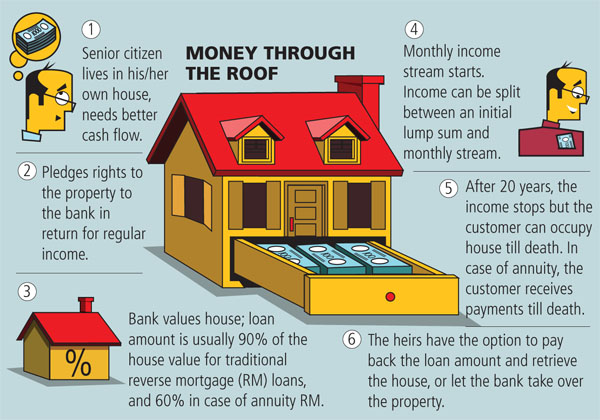

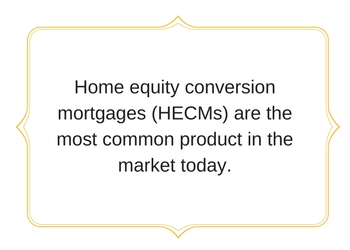

Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose. Web Reverse mortgages are an innovative way for seniors to fund their retirement by tapping into accrued home equity. The History of.

Web With a Seniors First Reverse Mortgage you are not required to make regular repayments. Equal monthly payments a line of credit a combination of the two. Web A reverse mortgage is a loan available to senior homeowners 62 years and older that allows them to convert part of the equity in their homes into payments from lenders.

Seniors may use reverse mortgages to help supplement their Social Security or other retirement income. The reverse mortgage can be taken in several ways. The minimum you can borrow varies but is typically about 10000.

Web Reverse mortgage is one way to build wealth for seniors. Web A reverse mortgage increases your debt and can use up your equity. For loans equal to 60 or less of the homes appraised value this premium.

Although interest is charged like any loan the borrower is not required to make repayments although they can usually make voluntary payments if they wish. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest. If youre age 60 the most you can borrow is likely to be 1520 of the value of your home.

A reverse mortgage can help you pay off debt and live more securely in retirement. Web Reverse mortgages are usually advertised as an easy way for older homeowners to access money. Web What is a reverse mortgage.

In other words its a way to turn the equity in your home into cash. You dont have to pay taxes on the proceeds or make monthly. In a reverse mortgage the lending.

The loan company pays the homeowner instead of the other way around. Your debt keeps going up and your equity keeps going down because interest is added to your balance every month. But most reverse mortgages are risky and getting one isnt necessarily a good idea.

Web Reverse mortgages are unique in that they can only be given to homeowners aged 62 years or older. Many people think it is a new idea but reverse mortgages and their many benefits have actually been a viable option for senior homeowners for over five decades. These loans have many benefits such as giving seniors access to needed money and drawbacks such as spending the equity in something thats commonly considered part of a seniors estate to be inherited.

Heres how it works and how you can get one. This form of loan allows borrowers to stay living in their homes throughout their retirement only requiring repayment after a designated maturation event. Web A reverse mortgage is a home loan that allows homeowners 62 and older to withdraw some of their home equity and convert it into cash.

Web A reverse mortgage is a loan taken by senior citizens on the equity of their home loan that they will not pay back as long as the home is their principal residence. It lets you convert a portion of your homes equity into cash. Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your homes equity as loan proceeds.

A HUD Housing and Urban Development reverse. You can continue to live in your home during the time the reverse mortgage is in force. As a guide add 1 for each year over 60.

Reverse mortgages have been around for a while but have gained a considerable amount of popularity in recent years. Web A reverse mortgage allows you to borrow money using the equity in your home as security. The total loan amount including interests can be repaid when you pass away move into long-term care sell your property or move out permanently from your home.

Web A reverse mortgage is an interesting route to take if you are a senior with enough home equity who needs an additional source of income. Generally funds help people pay for basic living expenses and health care but there is no stipulation on what the money can. So at 65 the most you can borrow will be about 2025.

Web A reverse mortgageis a type of loan for homeowners aged 62 and older. To make ends meet 60 of seniors said they cut back on discretionary expenses with many scaling back on dining out traveling and. Web Reverse mortgages often come with high fees and closing costs and a potentially costly mortgage insurance premium.

Web Reverse mortgages enable homeowners to access the equity in their homes and use it to pay expenses such as credit card debt an existing mortgage and medical costs. Web A reverse mortgage is actually a loan but one in which the lender taps into the equity of your home and pays you a monthly stipend. Contact Senior Strong for all your other senior housing needs as well.

A reverse mortgage works in the opposite way of the traditional mortgage. Web A reverse mortgage is a loan for seniors age 62 and older. Home Equity Conversion Mortgages HECMs the most common type of reverse mortgage loans allow homeowners to convert their home equity into cash with no monthly mortgage payments.

Web Reverse mortgage loans allow seniors to pull equity out of their homes in the form of a cash loan.

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Get The Best Life Insurance Rates In Canada Comparewise

![]()

Reverse Mortgage What It Is How Seniors Use It Nerdwallet

What Are Reverse Mortgages And Do They Target The Elderly Are Reverse Mortgages Good For Seniors Oppu

A Guide To Reverse Mortgages For Older Adults

Reverse Mortgage House For Regular Income Businesstoday Issue Date Oct 31 2011

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

Changes May Be Coming To Reverse Mortgage Rules But What Do They Mean

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Real Estate Issue 2022 By Montecito Journal Issuu

Everything You Need To Know About Reverse Mortgages Bankrate

Everything You Need To Know About Reverse Mortgages Bankrate

A Guide To Reverse Mortgages For Older Adults

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

10 Mortgage Form Templates In Pdf Doc

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch